Starting your own business is a big milestone—and registering it legally is the first step toward building a credible, recognized company. In India, the most preferred business structure is a Private Limited Company (Pvt Ltd) due to its many advantages like limited liability, separate legal identity, and ease in raising funding.

In this blog, CRM And Company, a professional CA firm in Lucknow, explains the step-by-step process to register a Private Limited Company in India, documents required, legal compliance, and tips to make your registration journey smooth and stress-free.

What is a Private Limited Company?

A Private Limited Company is a type of company that is privately held for small to medium-sized businesses. It limits the owner’s liability to their shares, restricts shareholders from publicly trading shares, and requires a minimum of 2 directors and 2 shareholders.

Key Features of a Private Limited Company

-

Minimum 2 and Maximum 200 members

-

Limited liability of shareholders

-

Separate legal entity from owners

-

Eligible for FDI (Foreign Direct Investment)

-

Mandatory compliance and audit filings

-

Preferred by investors and VCs for startups

Why Choose Pvt Ltd Company Over Other Structures?

| Structure | Liability | Ideal For |

|---|---|---|

| Proprietorship | Unlimited | Freelancers, small shop owners |

| Partnership | Unlimited | Small businesses with 2+ owners |

| LLP | Limited | Professional firms |

| Private Limited | Limited | Startups, scalable businesses |

A Pvt Ltd Company offers higher credibility and legal protection, which makes it the preferred option for tech startups, service providers, and businesses planning to scale.

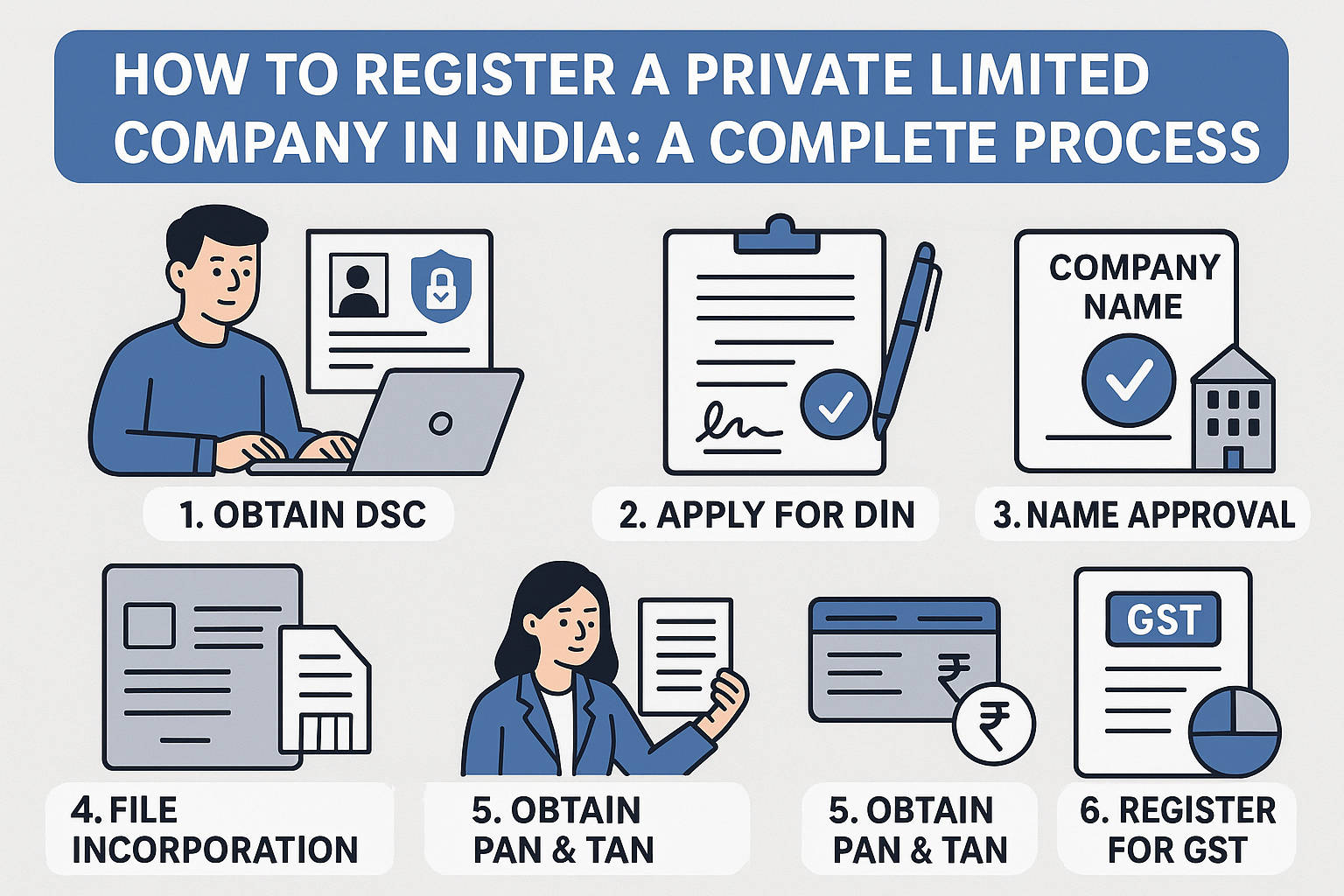

Step-by-Step Process to Register a Private Limited Company in India

Let’s now walk through the entire company registration process step by step:

Step 1: Obtain Digital Signature Certificate (DSC)

Since all company registration documents are submitted online through the MCA (Ministry of Corporate Affairs) portal, a Digital Signature Certificate (DSC) is required for all proposed directors and subscribers.

Documents Required:

-

PAN Card

-

Aadhaar Card

-

Passport-size Photo

-

Email ID and Mobile No.

✅ Time Required: 1–2 working days

Step 2: Apply for Director Identification Number (DIN)

DIN is a unique 8-digit number allotted to each director by MCA. It is used to track directorships across companies.

Since 2021, DIN is automatically generated at the time of SPICe+ form filing (during registration), so no separate application is needed.

Step 3: Name Reservation Using SPICe+ Part A

Your next step is to reserve a unique company name through the MCA portal using the SPICe+ Part A form.

Guidelines:

-

Name should be unique and not identical to existing companies or trademarks

-

Can reserve up to 2 names with priority

-

Add “Private Limited” at the end

Example: LucknowTech Solutions Private Limited

✅ Time Required: 2–3 days

✅ Fee: ₹1,000 for name reservation

Step 4: Prepare MOA & AOA

MOA (Memorandum of Association) and AOA (Articles of Association) are two key legal documents.

-

MOA defines the company’s objectives and scope of operations

-

AOA outlines internal rules, governance, and duties of directors/shareholders

Both documents are filed as e-forms (e-MOA and e-AOA) under the SPICe+ application.

Step 5: File SPICe+ Form for Company Incorporation

Once the name is approved, file the complete incorporation form called SPICe+ (Part B), which includes:

-

Company Details

-

Directors and Shareholders Details

-

Registered Office Address

-

Capital Structure

-

MOA & AOA

-

Declaration & Consents

This integrated form also includes:

-

AGILE-PRO-S: For GST, EPFO, ESIC registration

-

e-MOA & e-AOA: For drafting legal documents

-

PAN & TAN Application: Automatically applied along with incorporation

✅ Fee: Varies based on authorized capital

✅ Time Required: 3–5 working days

Step 6: Receive Certificate of Incorporation (COI)

If all documents are in order, the Registrar of Companies (ROC) will issue a Certificate of Incorporation (COI) with:

-

Company Name

-

Corporate Identification Number (CIN)

-

Date of Incorporation

-

PAN and TAN details

Your Pvt Ltd Company is now officially registered and ready for business.

Documents Required for Pvt Ltd Registration

From Directors & Shareholders:

-

PAN Card (mandatory for Indian citizens)

-

Aadhaar Card / Passport / Voter ID

-

Passport-size photo

-

Email ID & Mobile Number

For Registered Office:

-

Electricity Bill / Rent Agreement / Property Tax Receipt

-

NOC from property owner

Post-Incorporation Compliance Checklist

After incorporation, you must complete a few post-registration formalities:

-

Open a Current Bank Account

-

Deposit Paid-up Capital

-

File Form INC-20A (Declaration of Commencement) within 180 days

-

GST Registration (if applicable)

-

Issue Share Certificates

-

Maintain Company Registers

-

Appoint Auditor within 30 days

CRM And Company can assist you with post-registration compliance, so you stay legally secure from day one.

Government Fees and Professional Charges (Approx.)

| Expense | Estimated Cost |

|---|---|

| DSC (2 Directors) | ₹1,500 – ₹2,000 |

| Name Reservation | ₹1,000 |

| Govt Filing Fee | ₹1,000 – ₹2,500 (based on capital) |

| PAN & TAN | Free (included in SPICe+) |

| CA/CS Professional Fee | ₹4,000 – ₹10,000 |

Total Cost: ₹6,000 to ₹15,000 (approx.)

Why Register Through CRM And Company?

As a trusted CA firm in Lucknow, CRM And Company offers:

-

End-to-end Pvt Ltd company registration

-

Quick DSC & name approval

-

Drafting of MOA, AOA, and incorporation documents

-

PAN, TAN, GST application

-

Free startup advisory

-

Post-incorporation compliance setup

-

Transparent pricing and professional service

Contact Us Today

Let professionals handle your business formation process.

👉 Call: +91-8858008114

👉 Email: crmandcompany20@gmail.com / info@crmandcompany.com

👉 Visit: www.crmandcompany.com

Final Thoughts

Registering a Private Limited Company in India is a structured but straightforward process—especially when done with expert guidance. From protecting your personal assets to building investor trust and gaining brand credibility, a Pvt Ltd company is the smartest choice for serious entrepreneurs.

With the right help, you can register your company in just 7–10 days and start building your dream business confidently.

Let CRM And Company help you turn your business idea into a registered success.